JOSH GORDON. Will Labor’s dividend imputation policy overwhelmingly affect the low paid? (ABC News)

Feb 1, 2019For months the Morrison Government has argued Labor’s controversial plan to raise more than $5 billion a year by scrapping refundable franking credits on dividends from shares is “not fair”.

The Claim

In a speech to the Alliance for a Fairer Retirement System, Assistant Treasurer Stuart Robert said the plan would hit some of the lowest paid Australians.

“How is that fair on the lowest paid, those with low fixed incomes, those who are retired?” he said.

“It is not fair.

“Any changes will overwhelmingly hit low and middle-income earners, with 84 per cent of the individuals impacted on taxable incomes of less than $37,000 …”

Will the changes mostly hit low and middle-income earners, with 84 per cent on taxable incomes of less than $37,000? RMIT ABC Fact Check investigates.

The verdict

Mr Robert’s claim is misleading.

He suggests Australia’s least well off will bear the brunt of the pain.

To make his case, Mr Robert relies on the taxable income of people claiming excess franking credits as a cash refund. This is problematic for a number of reasons.

First, taxable income does not include the largest source of income for many retirees: superannuation.

Superannuation income (for fund balances of up to $1.6 million) is generally not subject to tax in the retirement phase, and is therefore excluded from taxable income.

Second, in a related sense, taxable income often has little to do with wealth.

For example, the Grattan Institute has estimated that, when superannuation withdrawals are pared out of income data for retirees, almost half of the “wealthiest” 10 per cent of people over 65 report incomes of less than the $18,200 tax-free threshold.

Third, Labor’s policy applies to both individuals and superannuation funds. By focusing on individuals, Mr Robert is ignoring the impact that would flow through to members of superannuation funds, particularly self-managed superannuation funds, which account for almost half the refunds claimed.

Figures from the Parliamentary Budget Office show that almost a quarter of all refunds claimed in 2014-15 went to 33,761 self-managed superannuation funds with balances of over $2.4 million.

This is not to say the policy will have no impact on some individuals with modest incomes and wealth.

What is clear, however, is using the taxable income of individuals tells us little about the overall financial position of those affected, or about the fairness or otherwise of Labor’s policy.

What is dividend imputation?

The dividend imputation system was introduced by the Hawke government in 1987.

The logic was that the profits of Australian companies should not be taxed twice: first at the corporate level; and second at the shareholder level, after distributing profits as dividends.

Hence, “imputed” credits were attached to dividends, equivalent to the amount of company tax already paid on those dividends.

These credits, known interchangeably as imputation credits or franking credits, could be used to offset an individual’s tax bill.

The catch under the original system was that once an individual’s entire tax liability had been offset, any excess credits could not be claimed as a cash tax refund, and were effectively worthless.

In 2001, following the 1999 “Ralph Review” of business taxation, the Howard government changed the law to allow individuals and superannuation funds to claim “excess” imputation credits as cash refunds.

Under those changes, which apply today, if an individual or superannuation fund has imputation credits exceeding their tax liabilities, they are entitled to a cheque from the Government handing back the difference.

If an individual pays no tax (with a taxable income below the $18,200 tax-free threshold) they are entitled to a refund for all of their imputation credits.

According to Treasury documents released under freedom of information laws, in 2014-15 the value of franking credits refunded was $5.9 billion.

The largest portion, $2.6 billion, went to self-managed superannuation funds, followed by $2.3 billion to individuals, $700 million to tax exempt entities and $300 million to regulated superannuation funds.

In his claim, Mr Robert referred only to refunds claimed by individuals.

Background to the claim

The Coalition Government has repeatedly suggested the proposed changes are unfair for people on lower incomes.

For example, Treasurer Josh Frydenberg told Parliament on November 26, 2018:

Mr Frydenberg has continued to push the issue in the new year.

In a January 21 press release, he said despite Labor claims the policy would tax the rich “nothing could be further from the truth with about 84 per cent of those affected having a taxable income of less than $37,000, and 96 per cent of those affected having a taxable income of less than $87,000”

Prime Minister Scott Morrison (when treasurer) said the policy was a “cruel tax to hit retirees with small nest eggs”.

“These aren’t millionaires and multinationals,” Mr Morrison said in a press release.

“They are grandads and grandmothers simply seeking to support their own retirements. They are in Labor’s firing line while those with more means dodge the tax hit.”

Labor, on the other hand, argues the system of refundable imputation credits is an anomaly in the Australian tax system (and internationally) as most tax credits are non-refundable.

For example, the Low Income Tax Offset or the Seniors and Pensioners Tax Offset can be used to reduce tax liabilities, but they cannot be claimed as refunds if those tax liabilities are fully offset.

According a Labor policy paper, the “vast majority” of working Australians don’t receive cash refunds for excess imputation credits.

“Recipients of cash refunds are typically wealthier retirees who aren’t PAYG (Pay As You Go) tax payers. These are people who typically own their own home and also have other tax-free superannuation assets,”

The cost to the budget of the refund system for imputation credits is substantial. When the change allowing cash refunds was introduced, it cost the budget about $550 million a year, compared to about $5.9 billion a year in 2014-15, according to Treasury figures.

Labor’s plan

Labor is promising to reverse the Howard government decision to introduce cash refunds for excess imputation credits for individuals and superannuation funds.

Labor’s original policy, announced on March 13, 2018, would have applied to all individuals and superannuation funds claiming excess credits.

Two weeks later, on March 27, after warnings the policy would hurt some low and medium income pensioners receiving income from imputation credits, Labor announced what it called the “pensioner guarantee”.

Under this change, according to estimates by the Parliamentary Budget Office, some 320,000 pensioners and allowance recipients would continue to be able to claim cash refunds for excess imputation credits.

Opposition Leader Bill Shorten also promised self-managed superannuation funds with at least one pensioner or allowance recipient before March 28, 2018 would be exempt.

The PBO estimated this iteration of the policy would improve the budget position by $10.7 billion over the four-year budget period — about $700 million less than its original announcement.

Almost two-thirds of this revenue, or $6.9 billion, would come from superannuation funds, with the remainder ($3.8 billion) collected from individuals.

Tax-free retirement

After overhauling the dividend imputation system in 2001, the Howard government introduced other changes benefiting superannuated retirees.

Specifically, in 2006 it announced superannuation income streams would be tax free for individuals aged over 60 from July 1 2007.

As superannuation fund Sunsuper explains to its members, in addition to this measure, the investment earnings a superannuation fund earns for any person receiving an income stream from their superannuation savings are also now tax free.

Under the current rules, individuals can transfer up to $1.6 million into a tax-free, retirement phase superannuation account.

In the pre-retirement phase, superannuation funds generally pay 15 per cent tax on earnings.

This also allows them to benefit from franking credit refunds, as the current corporate tax rate on which the franking credit is based is 30 per cent.

Testing the claim

Mr Robert’s assertion is difficult to precisely assess independently, at least on publicly available data.

ATO statistics based on information contained in individuals’ tax returns do not capture all franking credit refunds.

As the ATO says on its website, individuals who are not required to lodge a tax return can still claim a refund.

And according to Treasury, there are “difficulties” in using tax data to estimate the number of people holding retirement phase accounts with self-managed superannuation funds who receive franking credit refunds.

The Grattan Institute’s Brendan Coates and Danielle Wood have pointed out the fragmented nature of the data on what retirees earn, what they own and what tax they pay.

“Personal income tax returns provide only a patchy picture of the earnings and wealth of retirees,” they wrote.

“Superannuation payouts have been tax-free since 2006: they don’t even have to be declared on personal income tax returns. And draw-downs of savings other than superannuation to fund retirement — whether shares, bank deposits or investment property — are not declared as income.”

The Australian Bureau of Statistics conducts a survey of share ownership and other assets for retirees.

But the survey does not include information on imputation credits received, nor tax paid.

Fact Check contacted the ATO and Federal Treasury requesting detailed data needed to assess the claim.

Two sources of data are available. First, documents marked “protected” prepared by Federal Treasury but released under freedom of information laws provide an analysis of the impact of Labor’s plan, including by taxable income.

Second, the Parliamentary Budget Office has released two sets of analyses, the first requested by Liberal Democratic Party senator David Leyonhjelm, and completed in May 2018, the second requested by Labor MP Matt Thistlethwaite, and completed in November 2018.

The second of these analyses was released after Mr Robert made his claim.

Who bears the burden?

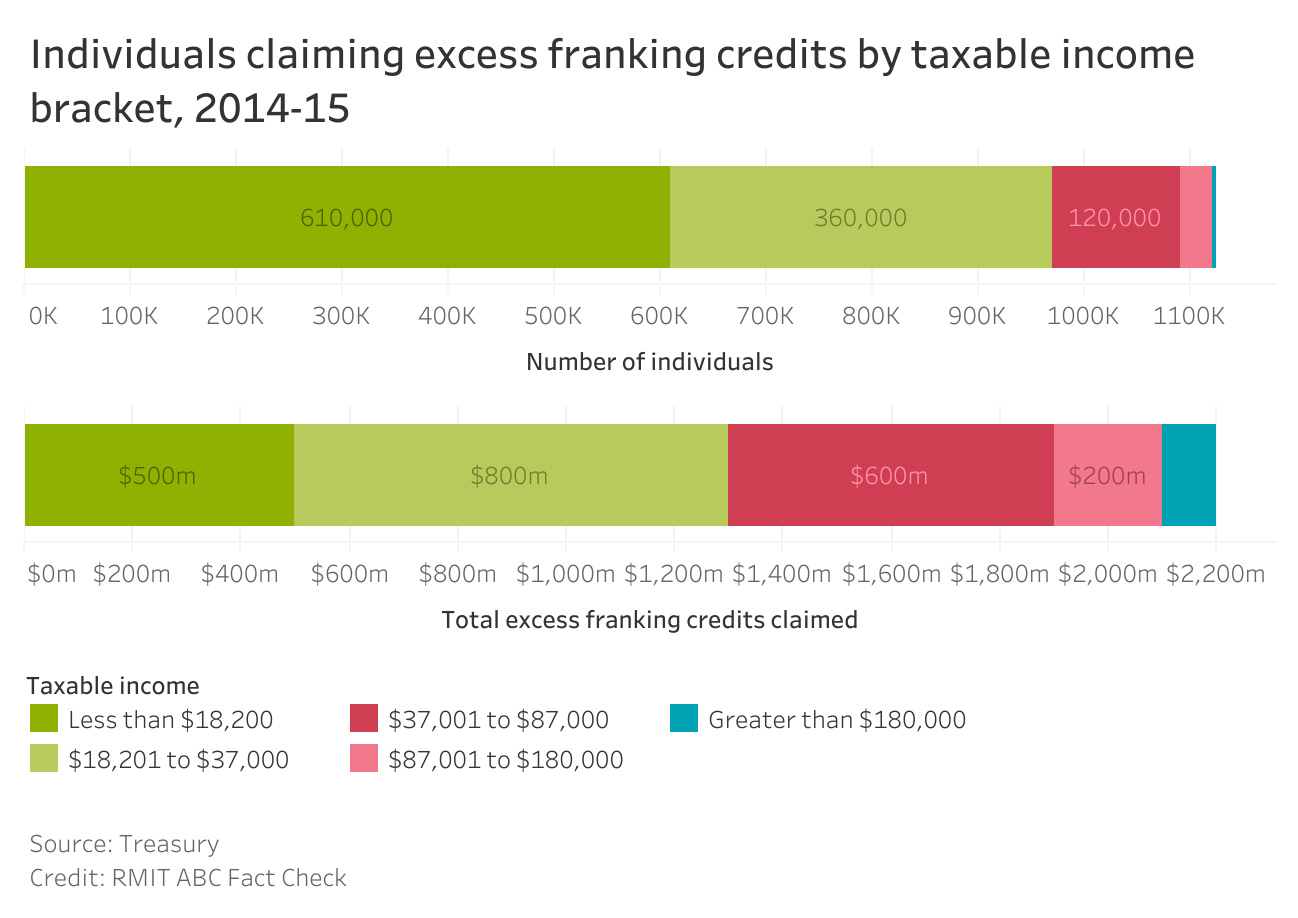

Federal Treasury undertook an analysis of 2014-15 taxation data to estimate the number of individuals claiming excess franking credits in various tax brackets.

As can be seen, according to Treasury’s analysis, 86 per cent of the individuals who received refunds had taxable incomes of $37,000 or less.

It is to some extent self-evident that the policy will mostly affect individuals on incomes below $37,000, because $37,000 is the threshold for the 32.5 per cent tax rate, higher than the corporate tax rate of 30 per cent that determines the franking credit.

As Treasury put it: “Providing refundability of franking credits allows taxpayers with a marginal tax rate below the company tax rate to receive a refund of tax paid by the company.”

Treasury also notes that individuals in the top two tax brackets receive “a small amount” of overall refunds, because of their high marginal tax rates.

“Refunds in these brackets would be limited to individuals with only a small proportion of income from other sources or a significant amount of tax losses/non-refundable tax offsets available,” it said.

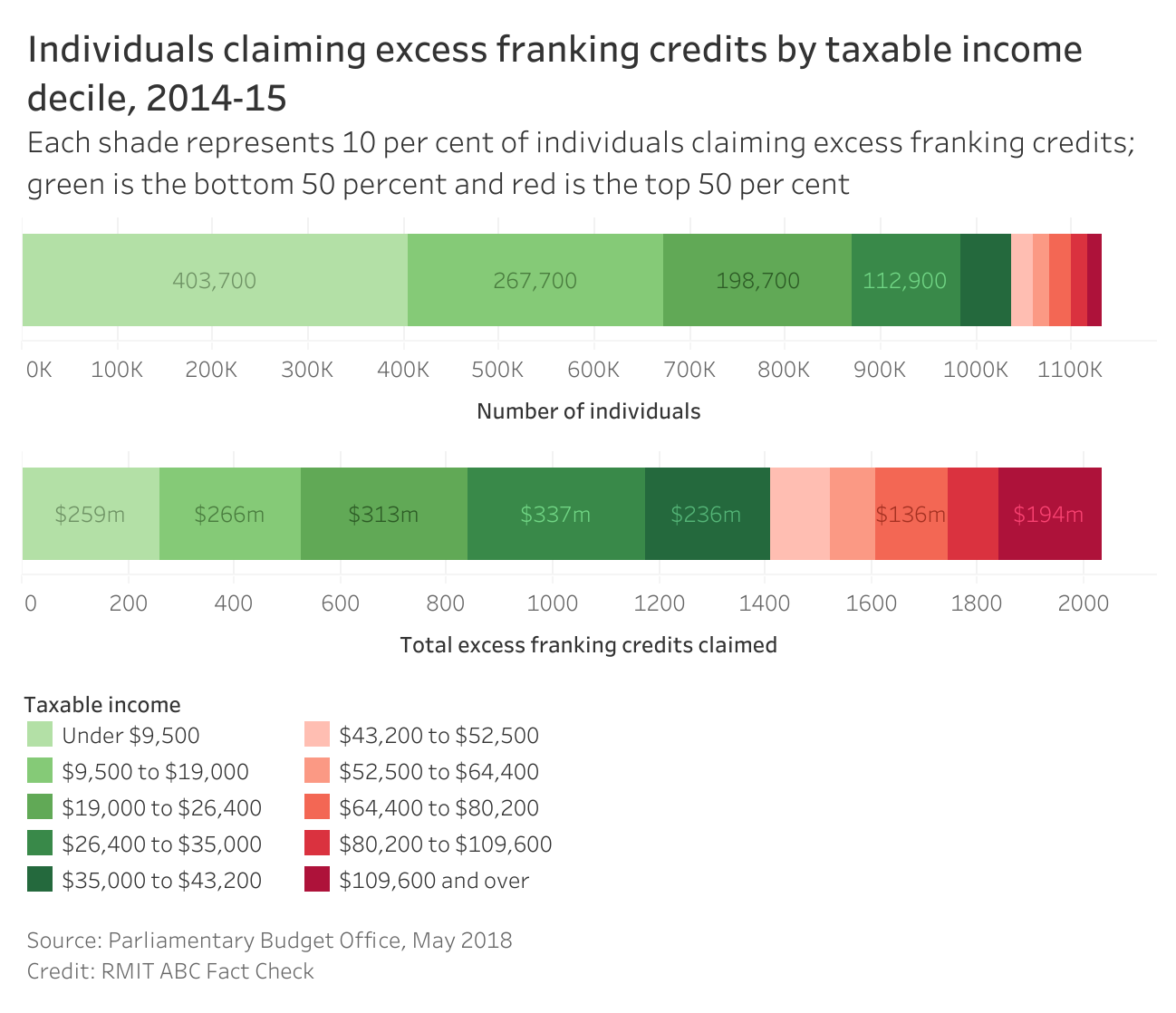

Modelling by the Parliamentary Budget Office roughly concurs with Treasury’s assessment. It analysed 2014-15 tax data by income decile, finding that 87 per cent of those affected have a taxable income below $35,000.

What about the impact of Labor’s “pensioner guarantee”?

According to the Parliamentary Budget Offices estimates, there are some 320,000 pensioners and allowance recipients who claim refunds for excess imputation credits.

Those estimates show the guarantee would reduce revenue by $300 million in 2021-22, or just 5 per cent.

The relatively small loss of revenue due to the guarantee in itself suggests most of the revenue from the policy is not coming from full or part pensioners, but wealthier retirees.

According to experts consulted by Fact Check, the bulk of pensioners and allowance recipients would have taxable incomes below $37,000, although a handful of part pensioners might have taxable incomes above $37,000 and dividend imputation credits exceeding their tax liabilities.

For the sake of analysis, Fact Check assumed that 95 per cent of the 320,000 pensioners claiming cash refunds had taxable incomes below $37,000, finding some 83 per cent of individuals affected by Labor’s policy have taxable incomes below $37,000, after making allowances for Labor’s Pensioner Guarantee.

Taxable income?

As previously noted, “taxable income” does not include the largest source of income for many retires: tax-free superannuation.

Nor does it tell us much about the overall wealth of those claiming refundable franking credits.

The Grattan Institute’s Ms Wood said analysing the changes by focusing on taxable income did little to explain the economic position of those affected by the policy change.

In a recent submission to a House of Representatives Inquiry, the Grattan Institute gave the following example.

“Take the example of a self-funded retiree couple with a $3.2 million super balance, plus their own home, and $200,000 in Australian shares held outside super. Even drawing $130,000 a year in superannuation income, and $15,000 a year in dividend income, they would report a combined taxable income of just $15,000 and pay no income tax whatsoever.”

Calculations by the Grattan Institute show when superannuation income is removed from ABS income and wealth survey data (reflecting taxable income), almost half of the wealthiest 10 per cent of those over 65 report income of less than the $18,200 tax free threshold and thus pay no tax.

On average, however, this group had wealth of nearly $2 million, even before factoring in the value of their home or other property assets.

This illustrates the extent to which individuals with relatively high levels of untaxed incomes (including from superannuation) and wealth have low taxable incomes.

Economic modelling on retirement savers by a group of academics from the College of Business and Economics at the Australian National University, including Associate Professor Adam Butt, Dr Gaurav Khemka and Associate Professor Geoff Warren, found the impact of Labor’s policy would be “greatest for wealthier retirees”.

“Our analysis … confirms that the impact of the proposed Labor policy will be greatest for retirees on larger balances, with significant effects occurring at initial balances at age 65 ranging from $800,000 up to the $1.6 million limit on tax-free retirement accounts,” the academics said in a submission (no. 158) to a parliamentary inquiry.

Another way to view the issue is to look at share ownership by wealth.

The Parliamentary Budget Office estimated the bottom 50 per cent of households by net wealth own just 3.2 per cent of the total value of Australia’s shares, with 72 per cent of the value of all shares held by the top 10 per cent.

What about superannuation funds?

Treasury has found that 90 per cent of the refunds accruing to superannuation are claimed by self-managed superannuation funds.

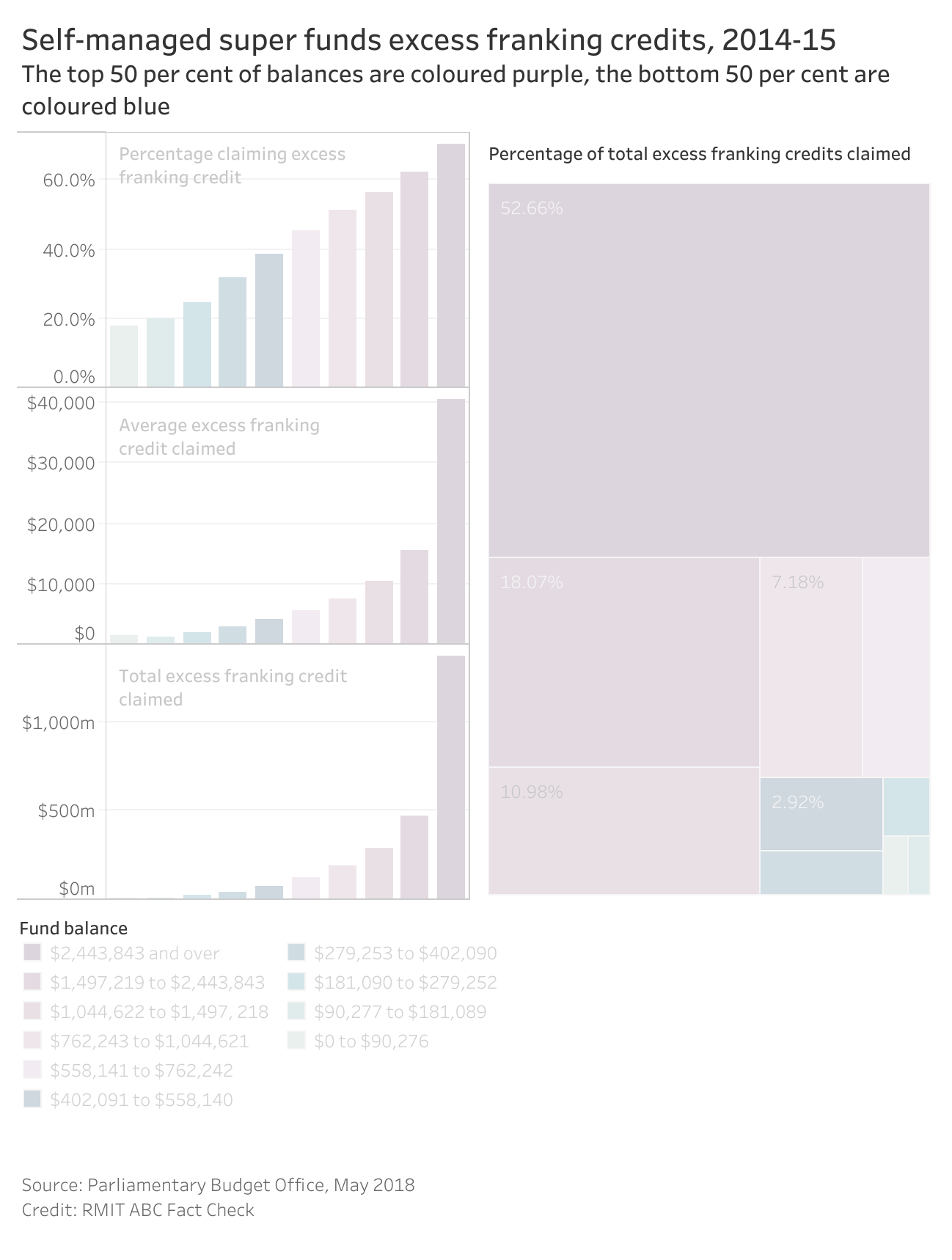

The Parliamentary Budget Office analysed the impact of the policy on this sector, finding that in 2014-15, 201,439 self-managed superannuation funds claimed almost $2.6 billion worth of excess franking credits.

The bottom half by fund balance claimed just 6.4 per cent of the total value, compared to more than half claimed by the top 10 per cent of funds with balances of more than $2.4 million.

When considered as a proportion of the total refunds claimed in 2014-15 by superannuation funds, individuals and tax-exempt entities combined, the 33,761 self-managed superannuation funds with balances of more than $2.4 million accounted for almost a quarter of all refunds.

Treasury analysed the refunds to self-managed superannuation funds by the balance per member, rather than by the total fund balance.

It found that “more than two-thirds of refunds to SMSFs are to those whose fund balance per member is greater than $1 million”.

What the experts say

Melbourne University tax law expert Professor Miranda Stewart said the use of taxable income to assess the impact of Labor’s dividend imputation policy “does not tell us very much”.

“In fact it is precisely because taxable income is low that a refund is achieved,” Professor Stewart said.

Ms Wood, from the Grattan Institute, said most of the people affected were self-funded retirees.

“And the reason they are affected is because they get refunds and the reason they get refunds is because they have low taxable incomes,” Ms Wood said.

“The reason they have low taxable incomes is because the income generated by self-managed super funds up to balances of $1.6 million is tax free. So their taxable income could be low but their actual income is often reasonably healthy, but they are still getting access to imputation credits.

Kathrin Bain, from the School of Taxation and Business Law at UNSW Sydney, said as a general rule most of those affected by Labor’s policy had marginal tax rates less than the company tax rate.

“To be affected by this policy you have to have a marginal tax rate that is lower than the company tax rate,” Ms Bain said.

“If you are just looking at individuals, of course it is going to affect people with lower taxable income.”

“In terms of whether it is fair, that goes into a theoretical debate about what the imputation system is meant to do. Some people would argue of course you should get a refund because the whole idea of our current imputation system is that dividends are effectively taxed at the individual’s marginal rate. On the other hand, others argue that our original imputation system shouldn’t have been changed to give a refundable tax offset. The argument there is that even if no refund is available, the dividend still has not been taxed at a rate higher that the company rate.”

Ms Bain said the current system of refundable imputation credits benefits superannuation funds that have a tax rate of 15 per cent and will often receive large tax refunds as a result of the imputation system.

Principal researcher: Josh Gordon, Economics and Finance Editor